If you're on the hunt for a versatile financial app that covers everything from banking to investing, look no further than SoFi: Bank, Invest & Loans. This app has been a game-changer for managing my finances, and I'm here to spill the beans on why it might just become your new favorite app too.

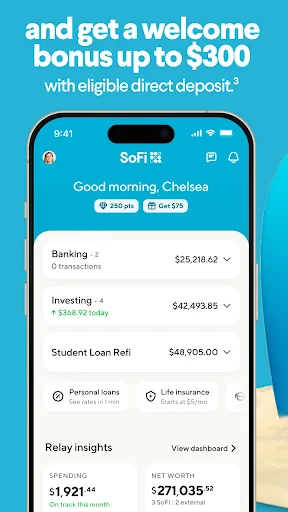

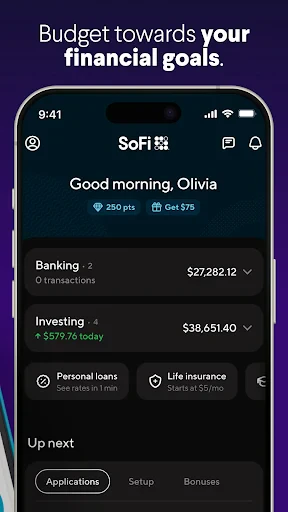

All-in-One Financial Powerhouse

SoFi: Bank, Invest & Loans isn’t just another banking app. It’s like having a financial advisor, investment guru, and budget tracker all in one place. It takes the hassle out of juggling multiple apps for different financial needs. Whether you’re looking to save, invest, or get a loan, SoFi has you covered.

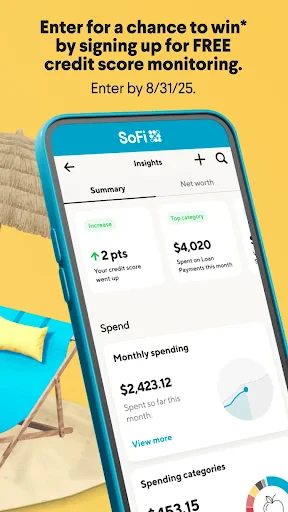

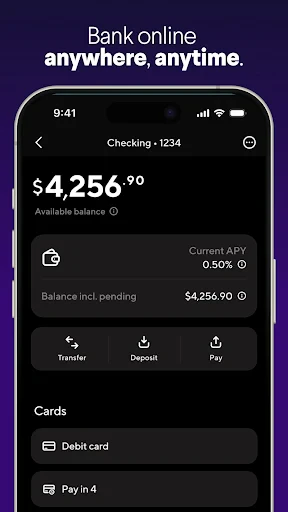

Sleek and User-Friendly Design

The first thing I noticed about SoFi is its sleek design. The interface is clean and intuitive, making navigation a breeze. Even if you're not the most tech-savvy person, you’ll find it easy to manage your finances with this app. Everything is clearly laid out, and you can access all features with just a few taps.

Banking Made Simple

With SoFi, you can say goodbye to complicated banking apps. It offers a seamless banking experience, complete with checking and savings accounts. What’s even better? Zero account fees. Yes, you heard it right. No hidden charges eating away at your savings. Plus, you can easily transfer money, pay bills, and even set up direct deposits without breaking a sweat.

Invest Like a Pro

If investing has always seemed like a daunting task, SoFi makes it incredibly approachable. Whether you’re a seasoned investor or just starting, the app provides personalized investment options. You can start with as little or as much as you want, and the automated investing feature takes care of the rest. It's like having a professional investor in your pocket.

Loan Solutions at Your Fingertips

Need a loan? SoFi offers a variety of loan options, from personal to student loans, and even refinancing options. The application process is straightforward, and the app provides clear information on rates and terms, so you’re never in the dark.

Community and Support

One of the standout features is the SoFi community. It’s a supportive space where you can connect with others, attend webinars, and even join events. Plus, if you ever hit a snag, SoFi’s customer support is just a tap away, ready to help with any issues you might encounter.

To sum it up, if you’re seeking a comprehensive financial app that makes banking, investing, and loans accessible and manageable, SoFi: Bank, Invest & Loans is worth checking out. It’s transformed the way I handle my finances for the better, and I’m sure it can do the same for you.